DiNapoli report indicates city is ‘susceptible’ to fiscal stress

A Sept. 26 report issued by the office of state Comptroller Thomas P. DiNapoli said the city of Glen Cove was “susceptible” to fiscal stress, noting that cash reserves were less than 5 percent of the city’s annual spending.

Based on the score they receive, municipalities can fall into one of three stress categories on the statewide list — susceptible, moderate or significant. Those whose finances appear sound, with no concerning debt or deficits, are given a “no designation” classification. The “susceptible” category is for municipalities with the least-serious budgetary problems. Despite some improvement in its financial management, Glen Cove made the fiscally stressed list for the 10th time in 11 years.

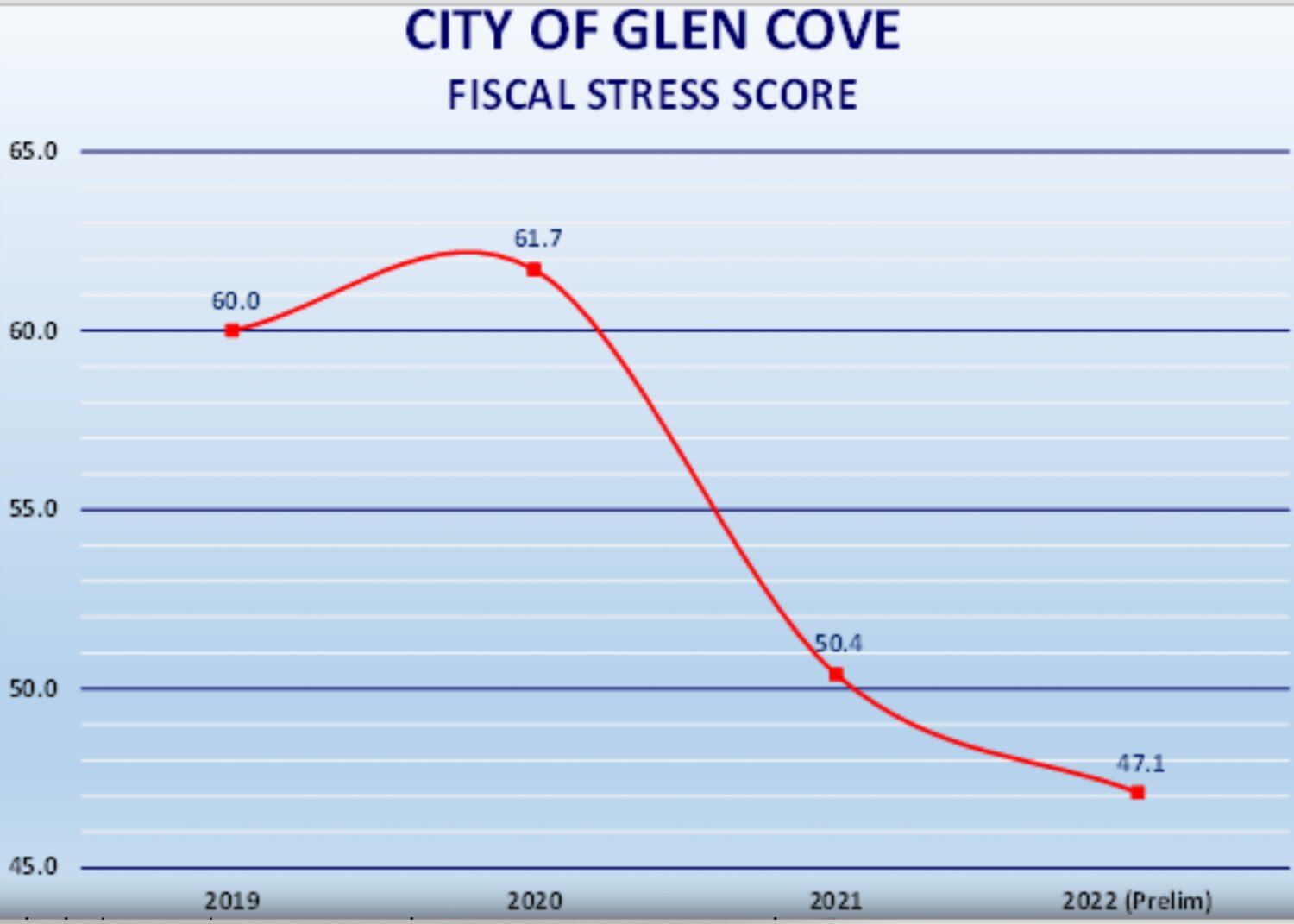

The comptroller’s office evaluates factors such as year-end fund balances, operating deficits, and debt and personnel spending to assess whether municipalities are at risk. The report gave the city a stress score of 47.1 out of 100 for the 2022 fiscal year, an improvement over Glen Cove’s 2021 score of 50.4 and its 2020 score of 61.7. Scores under 45 fall into the “no designation” category.

The report advises that reserves should be equivalent at least 20 percent of annual spending, but Glen Cove reported only $2.2 million in reserves at the end of last year, or 4.3 percent of its $50.5 million annual budget. It was one of 14 local governments cited this year in DiNapoli’s report.

City Councilwoman Marsha Silverman said she’s been advocating for long-term planning for many years, yet the city still budgets only one year at a time.

According to the comptroller’s website, DiNapoli launched the Fiscal Stress Monitoring System in 2013 to evaluate local governments’ financial indicators, including year-end fund balances, operating deficits, cash on hand, short-term borrowing, fixed costs and other factors. The system’s fiscal stress scores provide an early warning to local officials about potential fiscal issues, and give residents insight into their communities’ financial health.

“Our fiscal stress early warning system identifies potential financial problems for local governments so they can take corrective action to avoid problems down the road,” DiNapoli said in a statement. “The fact that fewer local governments were in fiscal stress in fiscal year 2022 was largely due to the infusion of aid from the American Rescue Plan Act and sales tax revenue growth. Sales tax collections have leveled off in recent months and federal dollars are being spent down, so localities should plan their budgets cautiously and accordingly.”

The report’s conclusion noted that many towns and villages benefited from increased sales tax revenue — the result of “an infusion of federal pandemic relief aid and, to a lesser degree, robust growth in local sales tax revenues,” the report reads. Fiscal challenges such as high inflation and increased municipal costs in 2021 and 2022 created financial pressure for many local governments.

Glen Cove Controller Michael Piccirillo said that the city has had some form of fiscal stress since the state comptroller began reporting the stress classifications.

“The city has been working diligently to improve our financial condition over the past several years by improving our budgeting practices, aggressively managing our expenses and implementing new revenue streams where possible,” Piccirillo, said. “Although our fiscal stress score for 2022 was maintained at the ‘susceptible’ designation, we have made a great deal of progress improving our finances over the last few years.”

Piccirillo added that based on the stress score calculations, after one more year of generating an operating surplus, the city anticipates a “no designation” classification when DiNapoli issues next year’s report.

Piccirillo noted that Glen Cove has received two consecutive credit outlook upgrades from Moody’s Investors Service, from negative to stable and stable to positive in 2022 and 2023, and said they were “further evidence of our significant financial improvement over the past few years.”